The California JPIA provides liability coverage that offers members two program options: the primary liability program and the excess liability program. Coverage in both programs includes bodily injury, personal injury, or property damage to a third party resulting from a member activity, including automobile liability. Employment practices liability is also a covered exposure. Claims for these programs are managed through a collaborative process with member communication and consultation. The California JPIA uses a third-party administrator to investigate and respond to all claims.

The California JPIA provides liability coverage that offers members two program options: the primary liability program and the excess liability program. Coverage in both programs includes bodily injury, personal injury, or property damage to a third party resulting from a member activity, including automobile liability. Employment practices liability is also a covered exposure. Claims for these programs are managed through a collaborative process with member communication and consultation. The California JPIA uses a third-party administrator to investigate and respond to all claims.

Primary Liability Program

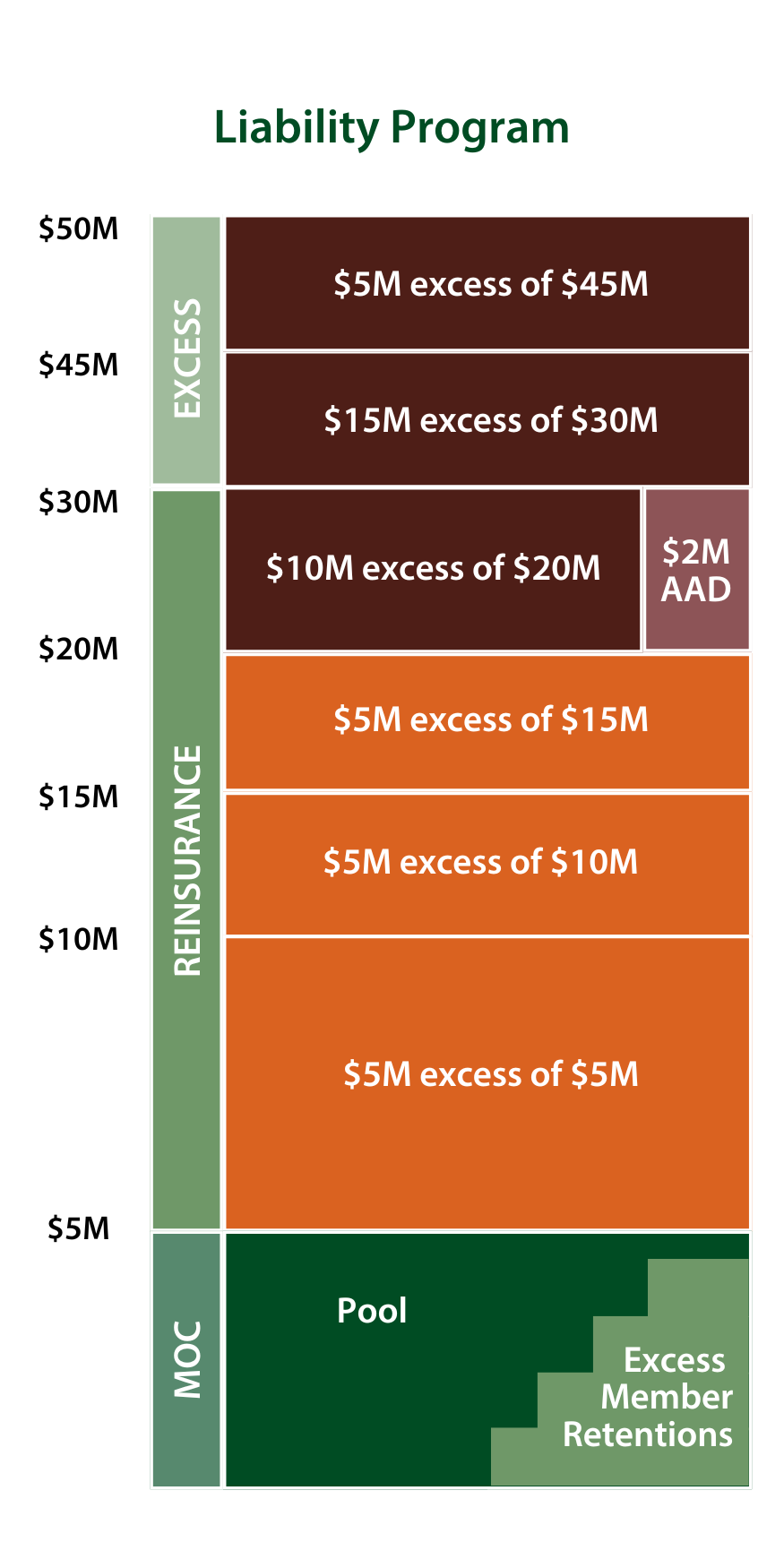

The primary liability program provides first-dollar coverage with no deductibles or member-retained limits. The program offers $50 million of coverage per occurrence and is funded at the 70% – 80% confidence level. Although claims are managed through a collaborative process, the Authority retains ultimate settlement authority. The program is funded by annual contributions that represent an “all-inclusive” charge that covers the pool’s retained layer, excess and reinsurance premiums, claims administration fees, operating expenses, and most training and risk management program expenses.

Excess Liability Program

The excess liability program provides for optional member-retained limits of $150k, $250k, $500k, $750k, or $1 million. This program has a coverage limit of $50 million per occurrence, and is funded at the 70% – 80% confidence level. Members retain settlement authority over claims within their layer, except for certain defined claim types that have catastrophic potential. Members use the Authority’s designated claims administrator and their own trust account for claim payments. In the excess liability program, members retain the right to select defense counsel from the Authority’s pre-approved panel. The program is funded by annual contributions from members that cover the pooled layer of losses, operating expenses, and most training and risk management program expenses. Member-retained losses and claims administration costs are paid directly by the members.

For both programs, the California JPIA handles claims from inception to closing through a partnership with Athens Administrators. Members need not worry about the details of handling claims, thereby allowing agency staff and resources to instead focus on risk management and preventing the occurrence of claims in the first place.

Claim Delegation

There are two options for the handling of liability claims filed against members. These options, explained below, allow a member to either delegate the claims handling responsibility to a staff member, or delegate the entire process to the Authority, which eliminates the need for the agency’s legislative body to take action or send letters to claimants.

Typical Claim Delegation Procedure

Under a non-delegated claims process, claims are presented to the clerk of the member agency. Athens Administrators then reviews each claim for its merits and contacts the member with a requested action based upon the review’s findings. When the determination is made that the claim should be rejected, there are two courses of action, depending upon the claim and prior actions of the legislative body:

- The legislative body of the member agency can take no action. The claim will then be deemed rejected by course of law 45 days after it was first presented to the clerk. Under this scenario, the time period in which a lawsuit may be filed is two years from the date of the occurrence; or

- The legislative body may choose to reject the claim at a public meeting and then send written notice of the rejection. Under this scenario, the time period in which a claimant may file a lawsuit is reduced to six months following the rejection.

Option 1: Staff Member Claims Delegation

As an alternative to the above non-delegated claims procedure, the legislative body may, by resolution, delegate the claims handling responsibility to a member of staff. That staff member then rejects the claim, shortening the time period in which to file a lawsuit to six months.

Option 2: Full Claims Delegation

A second option allows further streamlining of the process, whereby the legislative body may, by resolution, delegate the claims handling responsibility, in its entirety, to the Authority. This action allows the Authority, through Athens Administrators, to send notice of the rejection and shortens the time period in which to file a lawsuit to six months.

If your agency would like to utilize either of these two options, please see the information in the documents section of this page. The response form and certified copy of the adopted resolution must be mailed or emailed to the attention of Edith Vazquez at the California JPIA.