Insured Programs

The California JPIA’s insured programs represent commercial insurance programs, including all risk property, earthquake, mechanical breakdown, vehicle physical damage, pollution and remediation legal liability, crime, special events, and vendors/contractors. The California JPIA uses a third-party administrator to investigate and respond to all claims.

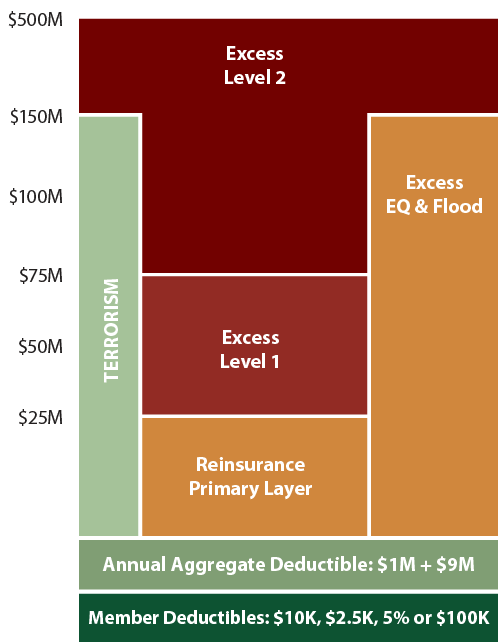

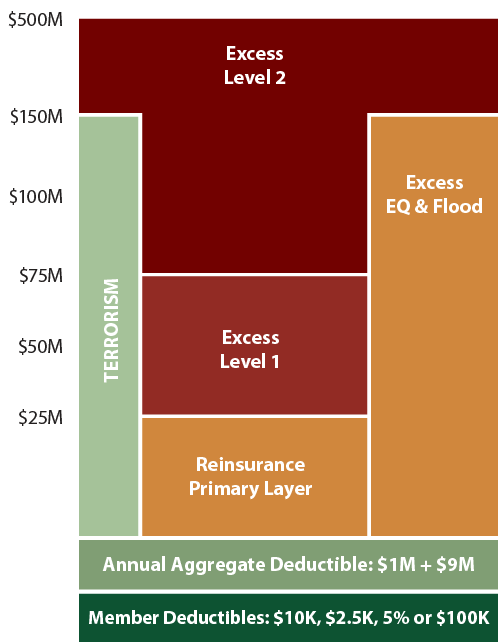

(Property Program Includes Optional Earthquake and Flood Coverage)

The property program includes all-risk coverage for real and personal property, including buildings, office furniture and equipment, fine art, contractor’s equipment, mobile and unlicensed equipment, vehicles, the property of others while in the member’s care, and buildings under construction.

The California JPIA uses third-party administrator Sedgwick, led by Tracy Aylor, to investigate and respond to all claims. Once a claim is reported, members are encouraged to contact Sedgwick with any claims matters.

Property

The property program includes all-risk coverage for real and personal property, including buildings, furniture and equipment, fine art, contractor’s equipment, mobile and unlicensed equipment, vehicles, the property of others while in the member’s care, and buildings under construction.

Optional coverage is available for earthquake and flood, high-value emergency vehicles such as fire apparatus and ambulances, and mechanical breakdown. Please see the documents section for additional information on each of the property program elements.

Rates are competitively priced based upon member exposures and experience.

Property Program

Property Schedules

All participants in the property program are asked to keep their schedules current and to maintain their accuracy. Since property schedules determine member premiums for property coverage, updates should add or delete buildings, equipment, and vehicles acquired or divested since the schedule was last updated. This is critically important as coverage terms may be different for property that is scheduled properly from property that is not. Additionally, the Authority requires all members to review current values listed for both property and vehicle schedules each year. The Authority has all buildings valued at $1,000,000 or more appraised every five to seven years by a professional appraiser to ensure they are properly valued.

Members may access their property schedules on Alliant Insurance Services’ online AlliantConnect system by clicking here. Please contact Donald Caskey for any assistance with AlliantConnect, including passwords or technical difficulties. Donald may be reached at (949) 527-9641 or [email protected].

Mechanical Breakdown

The mechanical breakdown program is optional and members are offered inspections of certain pressurized vessels, which are mandated by the State of California. The insurance carrier will conduct these inspections at no cost to the member and will help identify ways to prevent losses to valuable equipment. Members are contacted directly by the insurance carrier prior to the expiration of a vessel’s certificate.

Coverage is for both first- and third-party damages, including certain types of cleanups, listed non-owned disposal sites, and above-ground and underground storage tanks. Members work directly with the insurance carrier to investigate and respond to claims.

Coverage is for both first- and third-party damages, including certain types of cleanups, non-owned disposal sites, and above-ground and underground storage tanks. Members work directly with the insurance carrier to investigate and respond to claims.

If you believe a claim should be reported immediately, use the link on this page, even if you do not have all the information listed above.

Hazardous Materials Incident

- In the event of a fuel spill or hazmat incident, approach the scene cautiously, and avoid rushing in or taking action beyond your level of training or expertise

- Identify the hazard by consulting placards, labels, MSDS or other available sources of information

- Secure the area to prevent unauthorized access

- Contact local emergency response organizations

Underground Storage Tanks

The State of California mandates that all Underground Storage Tanks meet Financial Assurance requirements. Members have the option to obtain coverage through this program that meets this requirement. See the Pollution Program documents for additional information and details.

The cyber liability program provides coverage for both first- and third-party claims. Members work directly with a cyber incident coach to investigate and respond to incidents.

The cyber liability program provides coverage for both first- and third-party claims. Members work directly with a cyber incident coach to investigate and respond to incidents.

If an Incident or Breach Occurs

If a member becomes aware of an incident or breach, immediately call the Crisis Hotline at (877) 209-2009 or email [email protected]. If possible, please have the following information available when contacting the Crisis Hotline. Once a member contacts the Hotline, an incident coach will be notified and contact the member.

- Person most knowledgeable about the claim/incident with phone, alternate phone, and email

- Best time to reach contact

- Does the claim/incident involve services provided to anyone outside California?

Does the incident involve any of the following:

- Lost or stolen laptop or wireless device (BlackBerry, iPhone, smartphone)

- Other lost or stolen data storage device (thumb drive, portable hard drive, memory card)

- Use of / access to confidential information by someone who works for you

- Use of / access to confidential information by someone who does not work for you

For assistance with this program, contact Paul Zeglovitch by email or at (562) 467-8786.

The California JPIA contracts with Alliant Insurance Services for administration of this program. Coverage is provided for the following exposures: Faithful Performance, Depositor’s Forgery, Crime – money and securities, and Computer Fraud.

The California JPIA contracts with Alliant Insurance Services for administration of this program. Coverage is provided for the following exposures.

- Faithful Performance

Employee dishonesty, including theft, and failure of any employee to faithfully perform their duties. Includes all employees, the agency treasurer, agency clerk and/or tax collector and any employee required by law to be individually bonded.

- Depositor’s Forgery

Loss by forgery or alteration of, on or in any check, draft, promissory note or similar written promise, order or direction to pay money that is made or drawn upon the member’s accounts, including credit, debit, or charge cards, by someone acting as the member’s agent or that are purported to have been so made or drawn. This coverage protects you against forgery or alteration losses caused by a person other than an employee.

- Crime – money and securities

Covers loss of your money or securities by theft, disappearance or destruction while they are on your premises or on banking premises, or while your money or securities are outside your premises in the possession of a messenger. This coverage protects you from theft, robbery and safe burglary caused by persons other than an employee.

- Computer Fraud

Theft directly related to the use of any computer to fraudulently cause a transfer of money, securities or other property from inside the premises or banking premises to a person or place outside those premises.

Coverage provides liability insurance when member-owned premises are used for special events or short-term activities. Examples include weddings, art festivals, parades, block parties, yoga classes, and member-sponsored events such as job fairs, carnivals, and swap meets.

Coverage provides liability insurance when member-owned premises are used for special events or short-term activities. Examples include weddings, art festivals, parades, block parties, yoga classes, and member-sponsored events such as job fairs, carnivals, and swap meets. Members administer the program, accept funds, and issue certificates of insurance online with Alliant Insurance Services, with whom the California JPIA contracts for this program. There is no deductible, and the member is added as an additional insured, if entered on the certificate. Because it is automatic, members do not need to obtain an additional insured endorsement. Liability limits are purchased in $1,000,000 per occurrence increments. Medical payments are also available with limits of $5,000.

To use the program, access the Alliant website here. Instructions on how to use Alliant’s Special Events online system can be found here. Any necessary documents, including the program manual, can be found using the links on the right side of this webpage.

This program was developed to meet the needs of the public entity in assuring that there is insurance coverage in place for those situations where members enter into a contract with a contractor or vendor.

This program was developed to meet the needs of the public entity in assuring that there is insurance coverage in place for those situations where members enter into a contract with a contractor or vendor. By offering this coverage, the member will have the advantage of being able to contract with qualified bidders. Previously, these contractors could not participate as they often could not meet the member’s minimum insurance requirements. Coverage is provided for general liability only.

The Railroad Quiet Zone liability program provides coverage for bodily injury and property damage claims arising out of the acts or omissions of the insured at the Designated Quiet Zone noted in the declarations or by endorsement. Provides indemnification to the railroad when required by written contract.

The Railroad Quiet Zone liability program provides coverage for bodily injury and property damage claims arising out of the acts or omissions of the insured at the Designated Quiet Zone noted in the declarations or by endorsement, and indemnification to the railroad when required by written contract. There is also limited pollution coverage when caused by a railroad accident. There is a $100,000 self-insured retention per occurrence and a $1,000,000 limit per occurrence with a $1,000,000 program aggregate for all claims by all members.

In 2005, the Federal Railroad Administration (FRA) adopted the “Train Horn” rule which required that locomotive horns be sounded at public highway-rail crossings and provided flexibility to localities to silence horns through the establishment of “Quiet Zones.” The rule went into effect on June 24, 2005, at which time existing state and local whistle ban laws were preempted. Subsequently, several Authority members began the process of establishing “Quiet Zones.”

Under the MOCs for the primary and excess liability programs, the Authority does not provide coverage for railroad exposures, including “Quiet Zones” as approved by the FRA, or any liability members assume in contracts related to “Quiet Zones.” The MOCs do permit Authority staff to approve “Protected Contracts” with indemnity agreements pertaining to “Quiet Zones.” If the “Protected Contract” is approved, coverage is bound with the insurance carrier. Premiums are paid by the Authority and reimbursed by members.

Because the insurance carrier will not name operating railroads as Additional Insureds, members retain this exposure if they have agreed to it in a written agreement or contract. This results in a coverage gap for members, who will retain the full exposure for their contractual indemnification of an operating railroad.

The California JPIA contracts with Arthur J. Gallagher & Co. to administer this program. Members can contact Christopher Gray by email or (562) 467-8783 with any questions or to purchase this optional coverage.