Financial Information

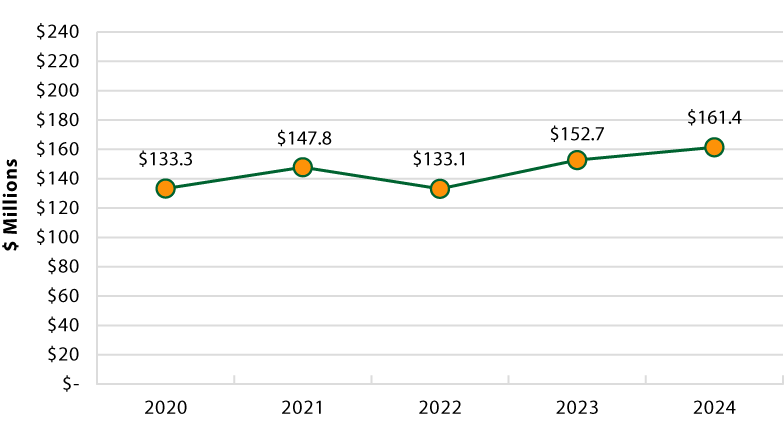

NET POSITION

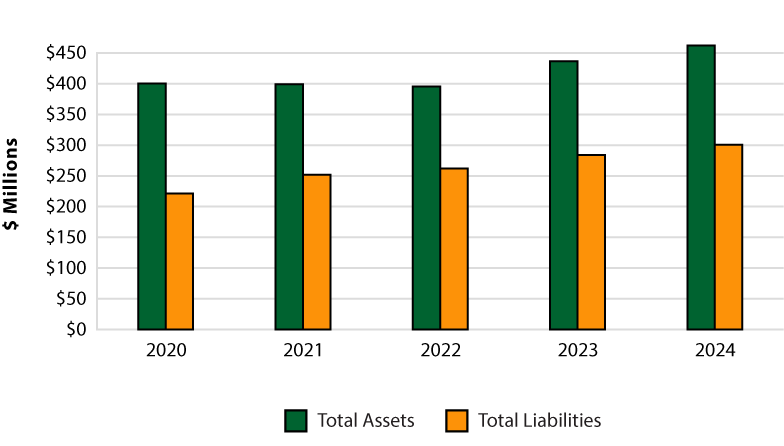

TOTAL ASSETS VS. TOTAL LIABILITIES

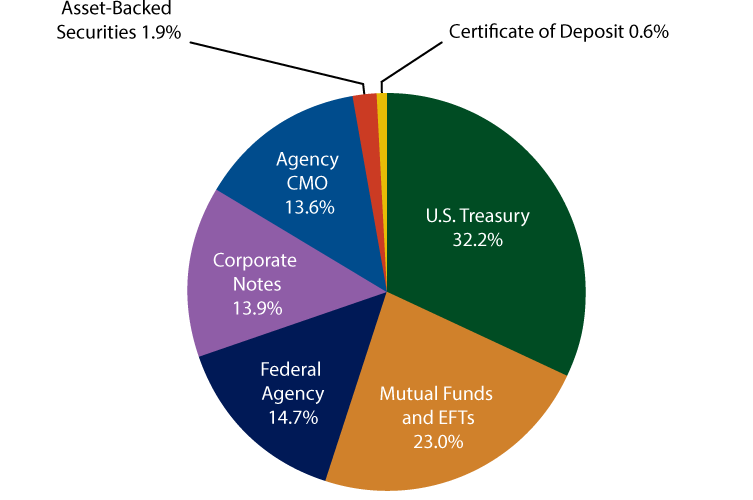

PORTFOLIO COMPOSITION

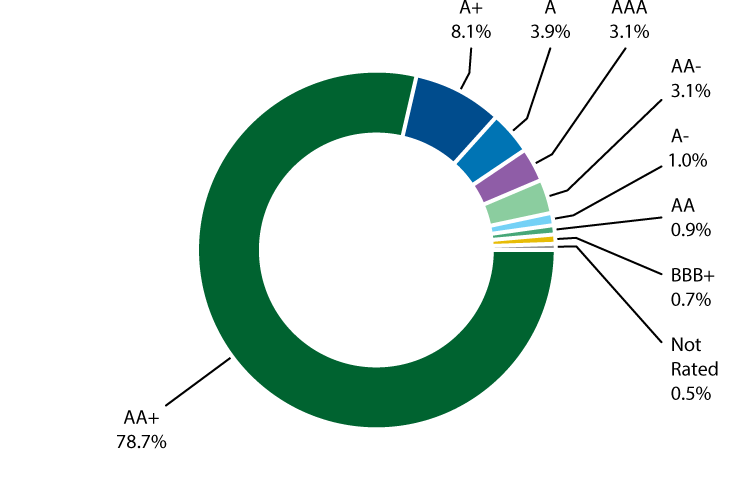

CREDIT QUALITY

Financial Documents

-

Budgets

- Adopted Budgets 2024–25 and 2025–26

- Adopted Budgets 2022–23 and 2023–24

- Adopted Budgets 2020–21 and 2021–22

- Adopted Budgets 2018-19 and 2019-20

Investment Policy

The Authority’s investment objectives are preservation of capital, maintaining adequate liquidity, earning a reasonable rate of return, and compliance with state law. The Authority’s investment program is administered by PFM Asset Management with oversight provided by the Executive and the Finance Officers Committee.

Member Contributions

Member contributions provide the pool with necessary resources for the defense and payment of claims and other coverage costs including excess and reinsurance premiums, claims administration, brokerage fees as well as risk management programs and services.

Primary Programs

Primary Liability Program Contributions 2025–26

Primary Workers’ Compensation Program Contributions 2025–26

Understanding the Annual Contribution Formula Primary Programs

Excess Programs

Excess Liability Program Contributions 2025–26

Excess Workers’ Compensation Program Contributions 2025–26

Understanding the Annual Contribution Formula Excess Programs

Retrospective Computations

Retrospective Computation October 2023 Liability

Retrospective Computation October 2023 Workers Compensation

Insured Programs

Property Contributions 2025–26

Pollution Contributions 2025–26

Crime Insurance Contributions 2025–26

Underground Storage Tank Contributions 2025–26

Underwriting Data Collection

Annual Payroll Exposure Report (APER)

The Authority collects calendar payroll and other data that is used to calculate each member’s upcoming Annual Contribution through the Annual Payroll Exposure Report (APER). This data is reported to the State of California, and it is provided to the Authority’s insurance carriers to use in determining the cost of reinsurance and excess insurance. Each spring, the data collection request is sent to agency staff serving in the following key roles: risk manager and finance.

Underwriting Report

The Authority collects data from members through the Underwriting Report. This data is provided to insurance carriers to underwrite the exposures of the Authority and its members, and to determine reinsurance and excess insurance rates and premiums. Each fall, the data request is sent to agency staff serving in the key role of risk manager.

Audit Confirmation Letters

The audit confirmation letters contain information regarding your agency’s coverage, and contributions paid for the fiscal year. This information is provided to your auditor via email in August or September.

Standard Footnote

The standard footnote regarding self-insurance pooling and purchased insurance is developed for your annual comprehensive financial report. Use of a standard footnote provides uniformity among members in making the disclosure. It is typically emailed to Finance Directors in August.